The Greatest Weapon Against the IRGC: American Business?

One of the key misconceptions you often encounter about the consequences of sanctions violations is that a monetary penalty can be imposed for breaking any of the U.S. sanctions on Iran. The reality is that civil penalties can only be levied against individuals or entities found in violation of U.S. primary sanctions contained in the Iranian Transactions and Sanctions Regulations (“ITSR”). For violations of U.S. secondary (i.e. extraterritorial sanctions), the only options available to the Treasury Department are fairly extreme – including asset freezes, prohibitions on transactions with the U.S. financial system, and prohibitions on the importation of any U.S. origin-goods. Any of these penalties can rightly be considered a nuclear option, particular when the potential target is a European company.

Consider the massive $8.9 billion fine imposed on BNP Paribas. U.S. regulators were able to extract this type of penalty not simply because BNP was operating in violation of U.S. sanctions. Rather it was because the bank processed illicit transactions through its New York branch or other U.S. financial institutions, thus providing the necessary “jurisdictional hook” for federal and state authorities to attach liability under U.S. law. If BNP had kept its dealings with Iran and Sudan entirely outside the United States, the only option available to U.S. government would have been to blacklist the bank. One can only imagine the response of the French government in that scenario.

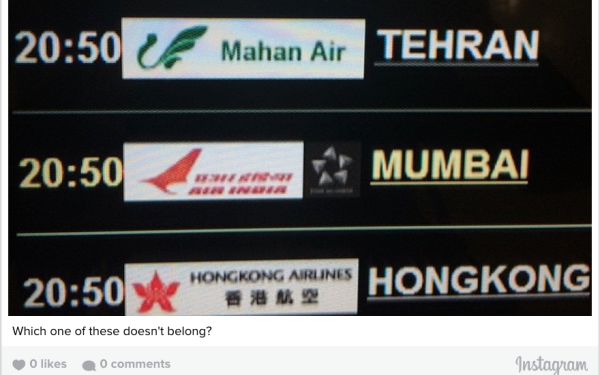

As it currently stands, foreign companies will be the primary beneficiaries of the sanctions relief the JCPOA provides. It also means that should the U.S. discover that deals are being signed with firms controlled by Iran’s Revolutionary Guard Corps (“IRGC”), the only choices are to politely (or not so politely) request a change in behavior, or use the above-mentioned nuclear option. A lack of clarity regarding what actually constitutes IRGC ownership or control for the purposes of secondary sanctions further weakens U.S. ability to compel foreign companies to avoid enriching IRGC-linked businesses in a post-deal environment.

For U.S. firms, the calculation is entirely different. Because U.S. sanctions operate under strict liability, even inadvertent violations, such as dealings with prohibited IRGC-owned or controlled entities can result in civil penalties. Under the International Emergency Economic Powers Act, the punishment for violations is $250,000 or twice the value of the transaction, per transaction. As there is little a U.S. company can do to contest these fines, U.S. companies would almost certainly conduct far more extensive due diligence than their European or Asian counterparts. This is turn could provide greater targeting data for Treasury, which will be itching to demonstrate that it retains the ability to target the IRGC.

While it’s hyperbole to actually suggest that U.S. investment would be the greatest weapon against the IRGC, the U.S. does have an interest in setting off a virtuous cycle whereby IRGC-linked entities are put at a competitive disadvantage in the “new” Iran. Allowing greater U.S. involvement could play a role.