OFAC SDNs, Payments, And The Barter System

One of the great ironies you witness over and over again when you practice in the field of U.S. economic sanctions, is that the implementation of the regulations administered by the United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) often lead parties who are acting in complete accordance with the law to carry out transactions in various manners that have all the hallmarks of traditional money laundering.

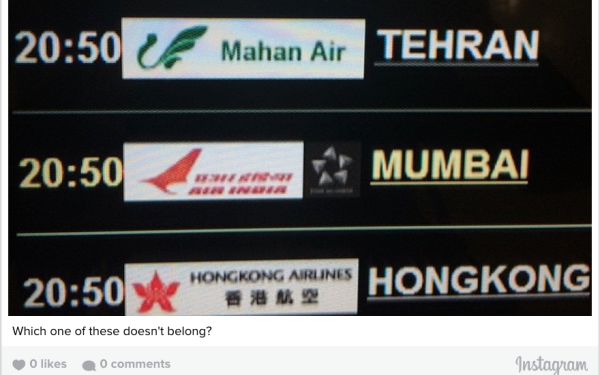

For example, if you want to receive a remittance of inherited funds from Iran to the United States–authorized under 31 C.F.R. 560.550–you have to have those funds routed through a third country bank before they come to the U.S. For a variety of sanctions related reasons, foreign financial institutions will not accept transfers from Iranian banks for this (and most other) authorized purposes, and as such, those parties seeking to remit the funds have to use money exchangers who often use accounts belonging to companies they own in third countries to send the funds to the U.S. The routing of a transaction through multiple companies and/or banks is commonly thought of in the money laundering world as “layering” which is considered to be one of common stages in the process of laundering funds related to criminal activity. Not that doing so in the scenario I just described is illegal, just that the method these funds travel would normally suggest suspicious activity.

Similarly, I recently came across a case where a transaction between a Specially Designated National (“SDN”)–a person targeted by a U.S. sanctions program a/k/a blacklisted–and a U.S. person for the provision of a service was authorized, and the U.S. bank to which the payment related to the authorized service was to come refused to receive the payment. This is despite the fact that the service being provided was generally authorized under the regulations, and the payment was specifically licensed by OFAC. When the bank refused, the U.S. person went to another bank. They refused. And another. They refused as well.

Here was a U.S. person, authorized to provide a service by OFAC regulations, holding a license to receive payment for that transaction, and no bank would touch it because they said it was “too risky” and they were worried about an OFAC violation. Let’s stop here for a minute. I understand banks’ concerns and their AML risk policies. But what I still haven’t been able to get a grasp on is why there is still so much fear on the part of banks for processing transactions which are clearly authorized and for which OFAC has provided written authorization for payment in regards to. (Queue up my bank compliance friends complaining about this post)

Anyway, the person here was a lawyer, and he was representing the SDN in a legal matter in the U.S. When stuck on how to receive payment due to the reluctance of the bank, the SDN made him an offer he couldn’t refuse: to pay him in luxury goods. The lawyer, being a good upstanding citizen, and wanting to make sure he didn’t get in trouble, sought guidance from OFAC on whether or not he could accept the goods as payment in place of a wire transfer of funds. In that particular case, OFAC’s answer was yes.

While I was happy for the lawyer, because he would at least be able to get some value for his services, I was a little bit surprised. I thought OFAC would balk at this type of barter transaction, but they seemed to be fine with it, and dare I say, almost sympathetic? But what does this mean in the big scheme of things? Does this mean that U.S. lawyers representing designated parties on the OFAC SDN List have found a loophole in cases where their clients are having difficulties paying through formal banking channels? Not necessarily. Remember ever transaction implicating OFAC sanctions has to be reviewed on a case by case basis. Therefore, one can’t automatically be sure that OFAC’s decision here was indicative of a standard policy, or if this was just a one time decision based on certain considerations.

What I am sure of, however, is that lawyers who are dealing with sanctioned parties and sanctions entities, really do need OFAC counsel. The way things play out in the real world aren’t always cut and dry. Interesting fact patterns come into play when you’re dealing with SDNs or parties in sanctioned jurisdictions, and I think it’s difficult for OFAC enforcement, or DOJ prosecutors, to believe that a trained lawyer screwed up in their interpretation of the law (although i definitely could see how it happens). As such, if you’re a lawyer who is representing an SDN and you aren’t well versed in OFAC regulations, or how OFAC policies and procedures, you may want to consider retaining counsel to make sure you don’t inadvertently violate the conditions of your OFAC license, the next time your SDN client pays you in rare jewels and rare artworks.

The author of this blog is Erich Ferrari, an attorney specializing in OFAC matters. If you have any questions please contact him at 202-280-6370 or ferrari@ferrariassociatespc.com.