More Sanctions Trouble at Standard Chartered

What is going on at Standard Chartered? Following significant penalties from U.S. authorities in 2012 and in 2014 alike, as well as the installation of an on-site monitor directly reporting to the New York State Department of Financial Services on Standard Chartered’s money-laundering risk controls, more bad news might be in store for the global bank.

Last week, a Financial Times investigation “identified transactions involving Iran that could put the bank at risk of severe penalties ranging from further fines to suspension or loss of its crucial dollar clearing license”:

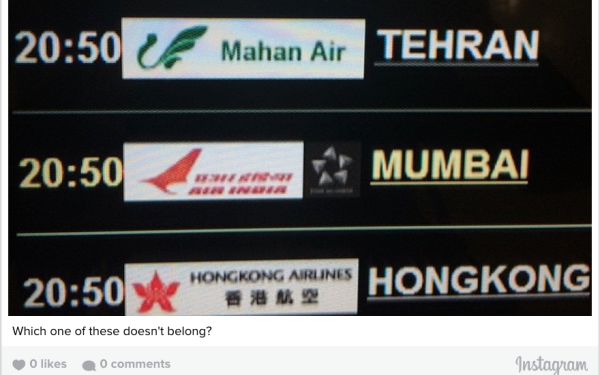

Documents seen by the FT suggest that StanChart continued to seek new business from Iranian and Iran-connected companies after it had committed in 2007 to stop working with such clients. These activities include foreign exchange transactions that, people familiar with StanChart operations say, would have involved the US dollar. The documents suggest the bank – a few months after a costly settlement with US authorities in 2012 – was still internally reviewing its client list and was unable to determine in certain cases whether customers were Iranian or not.

…

The U.S. Department of the Justice, the Manhattan district attorney, the Federal Reserve, the New York Department of Financial Services, and most recently, the New York attorney-general’s office, are all investigating StanChart for potential new sanctions breaches.

Some have long predicted that more trouble was at hand for Standard Chartered. The 2014 settlement agreement with the New York Department of Financial Services hinted at ongoing problems at the bank getting a grasp on adequate money-laundering controls to ensure no repeat offenses. Since then, news has arisen that U.S. and state authorities were investigating whether Standard Chartered had committed other sanctions violations, particularly in regards to Iran, following initial investigation of its activities in 2010-11 and perhaps even after its 2012 settlement agreement with U.S. authorities.

Based on FT’s story, however, it is difficult to tell the seriousness of the alleged offenses. Certainly, some of the allegations do not sound good for Standard Chartered. Take this one for instance:

Of particular interest to the authorities was the bank’s online trading system, known as OLT3 (On-line Treasury), according to documents seen by the FT. It allowed approved customers to conduct trades online, including foreign exchange transactions. As StanChart’s team gathered information to respond to U.S. requests, it noted significant flaws in the system, to which Bank Saderat at one point had direct access.

…

It is unclear whether StanChart reported this flaw to the authorities of its own accord. The document says: ‘all ‘Iranian’ clients who received direct access to the system were domiciled outside of Iran.’

Bank Saderat, as readers may be aware, was designated a Specially Designated Global Terrorist in October 2007. Pursuant to Executive Order 13224, the provision of financial support for or financial services to persons designated under the EO could subject a person to designation themselves. Moreover, the facilitation of any significant transaction or transactions with the Iranian bank has triggered the potential application of U.S. sanctions, including lost access to the U.S. financial system, since 2010 following passage of CISADA.

The prospect, then, that Standard Chartered was giving Bank Saderat backdoor access to trade in foreign currencies, including potentially the U.S. dollar, means that the past might still lie ahead for the bank.