Oops – OFAC Unblocks Over $3 Million in “Al-Qaeda” & “Sudan” Funds

Several weeks ago, OFAC published its 2014 Terrorist Asset Report (“TAR”), which lists all funds blocked pursuant to Specially Designated Global Terrorist (“SDGT”), Specially Designated Terrorist (“SDT”), and Foreign Terrorist Organization (“FTO”) sanctions programs, as well as funds from State Sponsors of Terrorism. According to the Report, as of 2014, $21,820,679 in terrorist organization funds were blocked and $2.35 billion from State Sponsor of Terrorism. As is usually the case, overall the amount of blocked funds increased from 2013-2014.

What is interesting about this particular report is that in two cases, the amount of blocked funds actually decreased significantly.

As of 2014, there was $12,782,698 in blocked Al-Qaeda money held in the United States, down from $13,503,338, a decline of $720,640. A footnote included in the report states:

The decrease in funds relating to Al-Qaida in 2014 is due to licensing activity authorizing the release of assets after determining the activity involved false positive name matches to parties on the SDN List.

The TAR also showed that $2.2 million in Sudan-linked funds were unblocked due to licensing stemming from false positives.

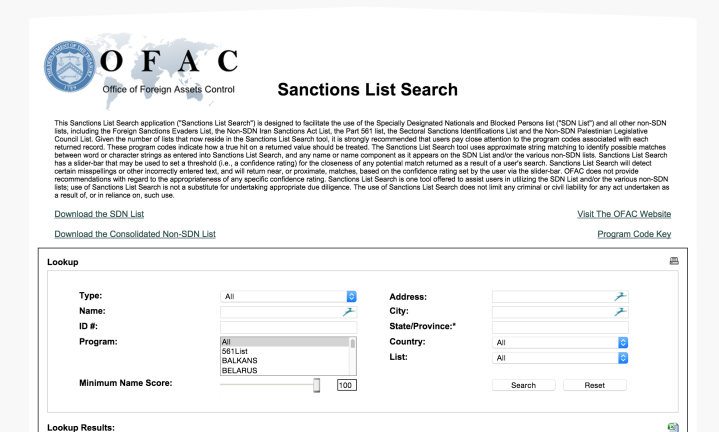

For the uninitiated, it’s important to remember that Treasury’s Office of Foreign Assets Control (“OFAC”) does not block i.e. freeze assets itself. Rather, it administers the regulations that require financial institutions subject to U.S. jurisdiction to block funds, which may be linked to individuals or entities on the list of Specially Designated Nationals and Blocked Persons (“SDN List”), or countries subject to U.S. sanctions. In order for funds to be unblocked, a license from OFAC is required.

What the TAR shows is that almost $3 million worth of funds blocked by financial institutions due to matches with persons on the SDN List, were blocked incorrectly. False hits produced by bank’s screening software are a persistent problem that affects both the banks through increased compliance costs from clearing false positives and individuals who suffer adverse effects from false matches. The Lawyers’ Committee for Civil Rights of the San Francisco Bay Area has done studies addressing this issue (see here and here), but false matches can be a big issue, particularly for individuals with Middle Eastern or Spanish names, as the majority of SDNs come from these two geographic regions.