Is Epsilon Electronics the Donald J. Trump of OFAC Enforcement Cases?

I’m going to have to pick up a new hobby once the United States Court of Appeals for the District of Columbia issues its decision in the matter of Epsilon Electronics v. The United States Department of the Treasury’s Office of Foreign Assets Control. For those of you who are new to the blog, have somehow missed my multiple Epsilon related posts, or otherwise are new to sanctions, the litigation involves Epsilon’s contesting of a penalty imposed by OFAC for violations of the Iranian Transactions and Sanctions Regulations (“ITSR”) arising from the export to a Dubai entity, which OFAC believes was intended for reexport to Iran.

Upon losing at the lower court level, Epsilon appealed their case to the U.S. Court of Appeals for the D.C. Circuit , and last month participated in oral argument before a D.C. Circuit panel that consisted of Judges Rogers, Griffith, and Silberman. I had noted this oral argument in my Fright Night post in November. That post described my surprise/horror that OFAC has taken a position that goods don’t actually need to be exported to Iran in order for their to be a violation of the regulations–which Epilson has said OFAC didn’t provide any evidence of prior to issuing its penalty. In OFAC’s briefings it had noted that all that was required for a violation of 31 C.F.R. § 560.204–the ban on exports of U.S.-origin goods, services, and technology to Iran–is for the U.S. exporter to have a reason to know the goods in question could be reexported to Iran. In other words, reason to know that goods could be reexported to Iran is an independent basis for a finding of a violation of § 560.204, and that a finding that the goods went to Iran is not necessary to support a violation of the prohibition. OFAC also went on to provide legal authority allowing an agency’s position to be stated for the first time–which this appeared to be–during litigation.

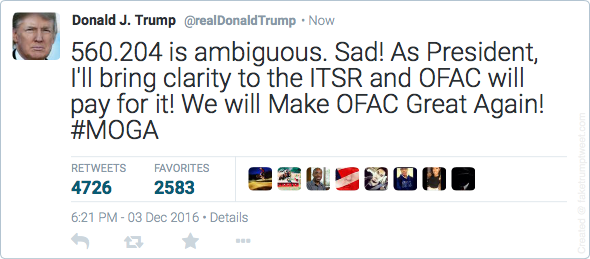

Over the last year or so I have been pretty pessimistic about Epsilon’s chances of winning this case. However, after listening to the audio of the oral argument, I’m starting to change my mind. Indeed, I’m starting to think Epsilon has the chance to pull off a stunning upset a la Donald Trump’s 2016 U.S. Presidential Election campaign. That change is not because of any arguments that were presented at the lower court, or in the briefings, but rather because the D.C. Circuit appears to be taking issue with the exact interpretation that the Fright Night post was focused on.

It appears that some of the Judges–Judge Silberman, in particular–aren’t too thrilled with OFAC’s interpretation of 31 C.F.R. § 560.204, and that there may be a decision in this case were Epsilon prevails for the following reasons: 1) § 560.204 is ambiguous; 2) the interpretation that there need not be a finding that goods make it to Iran has never been publicized before; 3) such interpretation for the first time during litigation is not appropriate given that a penalty was imposed.

In essence, it could be that the D.C. Circuit reverses OFAC’s decision upon a finding that the regulation is ambiguous. One of the key points here is whether reason to know the goods being shipped to a third country will be reexported to Iran is a requirement subordinate to the export of the goods to Iran–as opposed to an independent basis of liability. I think OFAC did a good job cleaning this up during their argument by stating that the regulation points out that the export of goods to Iran is prohibited, and that includes exports to a third country with reason to know they will be reexported to Iran. In other words, if you’re exporting to Iran, that is one basis of liability, but if you’re exporting to a third country (as were the facts in the Epsilon case) then the reason to know they would be reexported to Iran is a separate basis of liability.

The government also cleans up their argument as to why the goods don’t need to make it to Iran in order to have a violation by stating that the prohibition is on the export to Iran–not on the receipt of the goods to Iran. Since export means goods leaving the U.S. bound for Iran, it is not a requirement of 560.204 that the goods actually arrive in Iran, only that when the goods left (are exported from) the U.S. they were destined for Iran. Despite these explanations, Judge Silberman–who dominated the questioning at the oral argument–remained skeptical throughout (I have listed out some of his quotables below).

I think it’s going to be a close call, but that OFAC will ultimately prevail. I actually like Epsilon’s chances better than I liked Trump’s, and we all saw how that turned out. Indeed, 2016 has been a year of surprises–Brexit, Trump, Negan’s victims on the Season 7 premiere of The Walking Dead. Could Epsilon beating an OFAC penalty be the latest surprise of this year? Stay tuned folks, we just see the mighty OFAC take a loss.

Here are Judge Silberman’s (and one from Judge Rogers) quotables that have me thinking Epsilon has a shot:

- “You have a better argument….that no goods went to Iran.”–Judge Silberman

- “This is an interpretation of the regulation, right? Don’t you think that it’s fair to say the regulation is ambiguous….as to whether or not the reason to know is subordinate to the first part of the regulation requiring a determination that the goods went to Iran?”–Judge Silberman

- “I see that you have a better argument than you’re trying to articulate now. If you look at the penalty notice it says multiple facts tend to show that the goods exported to Asra were sent to Iran….it’s the penalty notice that we have before us and that doesn’t say the goods went to Iran, it says only that multiple facts tend to show that the goods exported to Asra were sent to Iran….there is no finding here that the goods went to Iran…you have a better argument which you implied–there is no finding that the goods went to Iran.”–Judge Silberman

- “You point out in your (OFAC’s) brief…that you’re entitled to our deference…in interpretation of your regulations, even in an adjudication, and even if you advance it for the first time. And that’s generally correct, but there’s a big exception isn’t there?…that doesn’t apply if you impose a penalty if you have an ambiguous regulation that could be interpreted one of two ways. You don’t impose a penalty without a prior indication as to what you’re interpretation of that regulation is.”–Judge Silberman

- “Let me ask you a question, has OFAC made a finding based on circumstantial evidence that the goods went to Iran? If that’s true, then we don’t have the problem with ambiguity…(Government affirms that OFAC has based on the “tends to show” language)…You know what? There’s a problem with that. It doesn’t say that, I wish it did, it doesn’t say that. ‘Multiple facts tend to show that the goods exported to Asra were sent to Iran.’ Now if that had started with a sentence and then included ‘therefore, we find that the goods went to Iran’, I would understand it. But OFAC didn’t say it, and your brief, which is very well written, sees that and then sort of slides off it.”–Judge Silberman

- “I’m trying to figure out what the devil OFAC meant when it said ‘Multiple facts tend to show that the goods exported to Asra were sent to Iran.’ That does not look to me to be a finding that the goods went to Iran. You know why, I’m afraid this isn’t talismanic. If you go back and look at the prior internal memorandums, the staff recognized we don’t have evidence the goods went to Iran….In an informal adjudication you can get by with a couple of paragraphs. But we have to read it carefully, and I don’t see that there’s a clear finding here that the goods went to Iran. ‘Multiple facts tend to show’ is not a finding.”–Judge Silberman

- “In reading the record it appears there was this statement to which Judge Silberman has focused, and then there’s a leap in the penalty that assumes the finding has been made. And in your (OFAC’s) brief I thought you acknowledge there wasn’t such a finding by saying ‘well predominantly the goods went to Iran’ and I thought well that doesn’t even cover all 34….We’re focusing on the point, we don’t see that finding.”–Judge Rogers

- “The first question is whether you have to make a finding, and I think the regulation is quite ambiguous…I would agree that if you had sent out an interpretative ruling that said you can be held in violation whether or not there’s an actual determination that the goods went to Iran, if you had reason to believe that they did go to Iran. I would say ok, that’s a legitimate interpretation. But I find it hard to accept that interpretation first in a case in which you impose a penalty. Then I look and see that whoever was doing the drafting of this well may have had this problem in mind, because the internal memorandums indicate that we don’t have evidence of a bill of lading, so we say multiple facts tend to show the goods exported to Asra were sent to Iran.”–Judge Silberman

- “You in your (OFAC’s) own brief pointed out the if there is ambiguity we should defer, even in litigation. And what you ignored was a line of cases indicating that if there’s an ambiguity in the regulation you get deference, even in litigation, provided you don’t impose a penalty for the first time…(OFAC states that Epsilon didn’t raise it so its been waived)..That’s a very interesting point. Amicus raises it. And in fact, you know what the problem is? You raised it. So we have case after case where the Petitioner doesn’t raise a point, but the Respondent raises it so you end up–you raised the point yourself.”–Judge Silberman

- “You’re imposing a pretty sophisticated burden on a pretty little company…the question is have you explained all of this? I’d feel more comfortable if you’d made a finding, and I’m also concerned about the ambiguity in the regulation.”–Judge Silberman

- “I don’t think it’s inconsistent, I think the regulation is ambiguous.”–Judge Silberman

The author of this blog is Erich Ferrari, an attorney specializing in OFAC matters. If you have any questions please contact him at 202-280-6370 or ferrari@ferrariassociatespc.com

P.S. The image contained in this post is not an actual tweet by the President-Elect.