Ready, Set, Wait: How You Can Predict Receiving an OFAC Administrative Subpoena or Grand Jury Subpoena

One of the most underreported aspects of the recent cases concerning banks being investigated and penalized by regulators–including the United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”)–for violations of various U.S. economic sanctions programs is the massive amount of information the banks turned over to the U.S. Government during that process. The information turned over by these banks to OFAC, other regulators, and even the Department of Justice is leading to a recent upward tick in the number of parties receiving subpoenas–both OFAC administrative subpoenas and grand jury subpoenas–concerning violations of U.S. sanctions in relation to certain transactions identified in those subpoenas. And what is the one common thread throughout these subpoenas? The payments related to those transactions were carried out through banks that were recently subjected to penalties for sanctions violations.

So what can be done to prepare yourself or your company to deal with such a subpoena? First, make a determination as to whether or not there have been any transactions with sanctioned countries or parties in the last five years. If so, look back at those transactions to determine what banks were involved in transferring funds related to those transactions, and whether those banks have recently been subjected to penalties for sanctions violations. For example, if you exported nutritional supplements to Iran four years ago, and you were paid through Standard Chartered Bank, then you would want to flag those payments and that transaction.

Second, gather all documentation relating to the transaction, and carry out any employee interviews or otherwise collect information concerning the transaction. As part of the factual investigation what you should focused on is determining whether any aspect of the transaction constituted a sanctions violation; whether there was an understanding between the parties, or by any of the parties, that the transaction was a violation; and the circumstances surrounding how the transaction came to be. For example, how did the parties meet, what was the relationship between the parties, and are the parties still in contact or do they have the ability to reestablish contact. This last consideration is mainly of importance to those swept up in a criminal investigation where the government seeks cooperation, as prosecutors and agents investigating sanctions violations will seek to determine whether relationships can be leveraged to investigate and prosecutors others involved in criminal conduct.

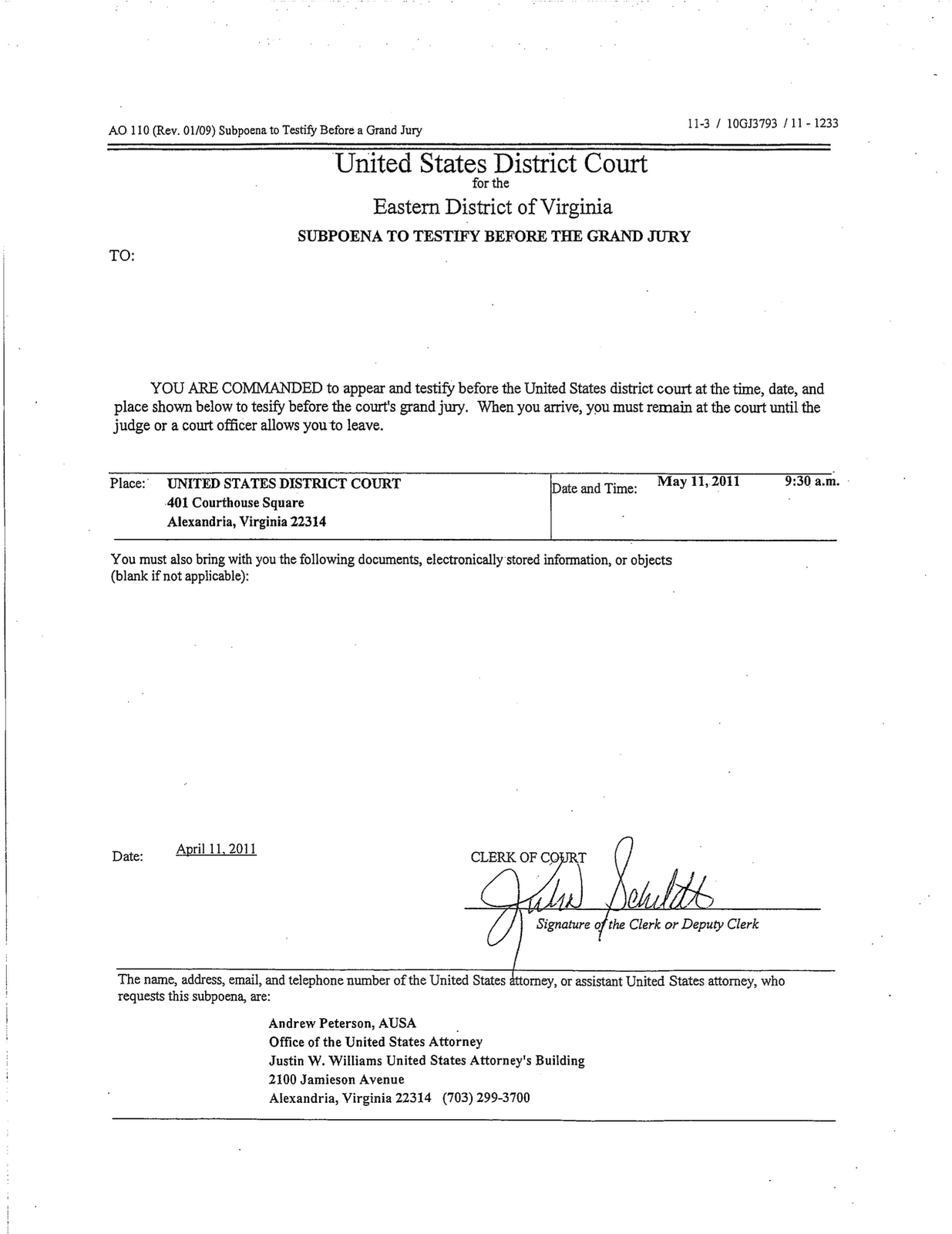

Finally, be prepared. When you receive an OFAC administrative subpoena or a federal grand jury subpoena, you often have a short time frame to respond. While extensions may be granted, there isn’t always enough time to carry out a full factual investigation, properly understand the facts, and have a response prepared. Thus, subpoena recipients often find themselves caught off guard, and panicked by the investigation. This can make articulating a proper response difficult. By preparing yourself in advance to respond to a possible future subpoena, you put yourself or your company in a much better position to defend against the investigation, and comply with your obligations to respond. While you won’t ever know the exact questions OFAC or the Department of Justice may ask, when it comes to sanctions you may get an idea if those questions will be coming just by watching the news and seeing what banks are being penalized.

The author of this blog is Erich Ferrari, an attorney specializing in OFAC matters. If you have any questions please contact him at 202-280-6370 or ferrari@ferrariassociatespc.com.