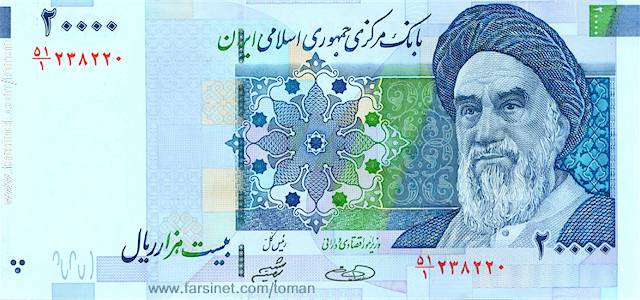

Iran’s Rial Continues to Drop

There have been a variety of news reports coming out in the past few days concerning the depreciation of the Iranian rial vs. the U.S. dollar. This is a trend that has been continuing for sometime. I recall in the summer of 2011 when clients were complaining about the exchange rate of 11,500 rials to the dollar. Now the reports coming out are that the rial is trading at 25,650 rials to the dollar. This depreciation has seem to come in waves, as the rate spiked shortly after the passing of Section 1245 of the National Defense Authorization Act of 2012 in January, and has again spiked in recent days.

There have been a variety of news reports coming out in the past few days concerning the depreciation of the Iranian rial vs. the U.S. dollar. This is a trend that has been continuing for sometime. I recall in the summer of 2011 when clients were complaining about the exchange rate of 11,500 rials to the dollar. Now the reports coming out are that the rial is trading at 25,650 rials to the dollar. This depreciation has seem to come in waves, as the rate spiked shortly after the passing of Section 1245 of the National Defense Authorization Act of 2012 in January, and has again spiked in recent days.

Some sources are reporting that the value has dropped by 12% alone this week. While proponents of tougher U.S and multilateral sanctions have lauded this development as a show of the effectiveness of sanctions, there have been some suggestions by those in the Iranian government that the rapid depreciation of the Rial is more tied to failed fiscal policies than any impact of recently implemented sanctions. While that could or could not be true, there has been a notable decrease in Iran’s oil exports and an increase in the difficulties in transferring funds that are due to the sanctions imposed both by the U.S. and Europe this year. Both of which suggest that sanctions are having an impact on Iran’s ability to sustain oil exports and to pay for imports of basic humanitarian products.

While statistical support for the theory that sanctions can squeeze Iran continues to dominate the news headlines these days, does this necessarily mean that the sanctions are effective? The answer will depend on what your definition of effective in relation to sanctions is. If you believe sanctions should be used as a method to harm a nation and its population, then yes it seems the sanctions are effective. However, if your belief is in line with the U.S. Government’s, namely that sanctions should be used to change behavior, then they do not appear to be effective as Iran has continued to operate in line with their own policy goals and objectives, without yielding to pressure from the United States and the rest of the world to deviate from those objectives.

The author of this blog is Erich Ferrari, an attorney specializing in OFAC matters. If you have any questions please contact him at 202-280-6370 or ferrari@ferrari-legal.com.